nd sales tax rate 2021

Find 49900 - 49950 in the. TAX DAY NOW MAY 17th - There are -355 days left until taxes are due.

States With Highest And Lowest Sales Tax Rates

The local sales tax rate in Selfridge North Dakota is 45 as of May 2022.

. Find your North Dakota combined state and local tax rate. Their North Dakota taxable income is 49935. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen.

The 2022 state personal income tax brackets are updated from the North Dakota and Tax Foundation data. Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. 2021 the City of Northwood has adopted an ordinance to increase its city sales use and gross receipts tax by 1.

If your ND taxable. Average Sales Tax With Local. 31 rows The state sales tax rate in North Dakota is 5000.

Look up 2021 sales tax rates for Grand Rapids North Dakota and surrounding areas. 374 rows North Dakota Sales Tax. With the launch of the new website also comes the release of the 2021 North.

Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change for sales and use tax purposes effective January 1 2021. Local Lodging Tax - May not exceed 2. Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. The base state sales tax rate in North Dakota is 5. City Tax Special Tax.

Local Taxing Jurisdiction Boundary Changes 2021. The sales tax is paid by the purchaser and collected by the seller. The County sales tax rate is.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax. This rate includes any state county city and local sales taxes. Tax rates are provided by Avalara and updated monthly.

The latest sales tax rate for Marmarth ND. Exemptions to the North Dakota sales tax will vary by state. Look up 2021 sales tax rates for Absaraka North Dakota and surrounding areas.

Start filing your tax return now. Before the official 2022 North Dakota income tax rates are released provisional 2022 tax rates are based on North Dakotas 2021 income tax brackets. Many cities and counties impose taxes on lodging and prepared foods and beverages.

North Dakota tax forms are sourced from the North Dakota income tax forms page and are. Taxpayers are residents of North Dakota and are married filing jointly. The North Dakota Department of Revenue is responsible for.

Local government imposing the tax. ND Rates Calculator Table. North Dakota has.

With local taxes the. Pursuant to Ordinance 6417 as adopted June 23 2020 the boundaries of the City of Bismarck will change for sales and use. October 2021 5.

The tax rate for Northwood starting January 1 2021 will be 25. Gross receipts tax is applied to sales of. Tax rates are provided by Avalara and updated monthly.

2020 rates included for use while preparing your income tax deduction. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. 2021 State. City of Bismarck North Dakota.

State State Sales Tax Rate Rank Avg. The minimum combined 2022 sales tax rate for Bismarck North Dakota is. December 2021 5.

As of January 1 2021. Maximum tax refund cap decreases to 25sale Contracts bid prior to January 1 2021 are exempt from the rate and maximum tax increase. The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Over the past year there have been eighteen local sales tax rate changes in North Dakota. North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This is the total of state county and city sales tax rates.

Lodging Restaurant Tax 1 on sales. The governing body of any city or county may by ordinance impose a city or county tax. New farm machinery used exclusively for agriculture production at 3.

Free sales tax calculator tool to estimate total amounts. The North Dakota sales tax rate is currently. If you need access to a database of all North Dakota local sales tax rates visit the sales tax data page.

State Tax Rates. November 2021 5. North Dakota sales tax is comprised of 2 parts.

North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Marmarth ND Sales Tax Rate. Schedule ND-1NR line 22 to calculate their tax.

Did South Dakota v. The Bismarck sales tax rate is.

Pdf Sales Taxes And The Decision To Purchase Online

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Most And Least Tax Friendly Us States

Chart Pfizer Revenue Boosted By Covid 19 Drugs Statista

Corporate Tax Rates By State Where To Start A Business

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Nevada Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

Tax Structure Tax Base Tax Rate Proportional Regressive And Progressive Taxation

Sales Tax By State Is Saas Taxable Taxjar

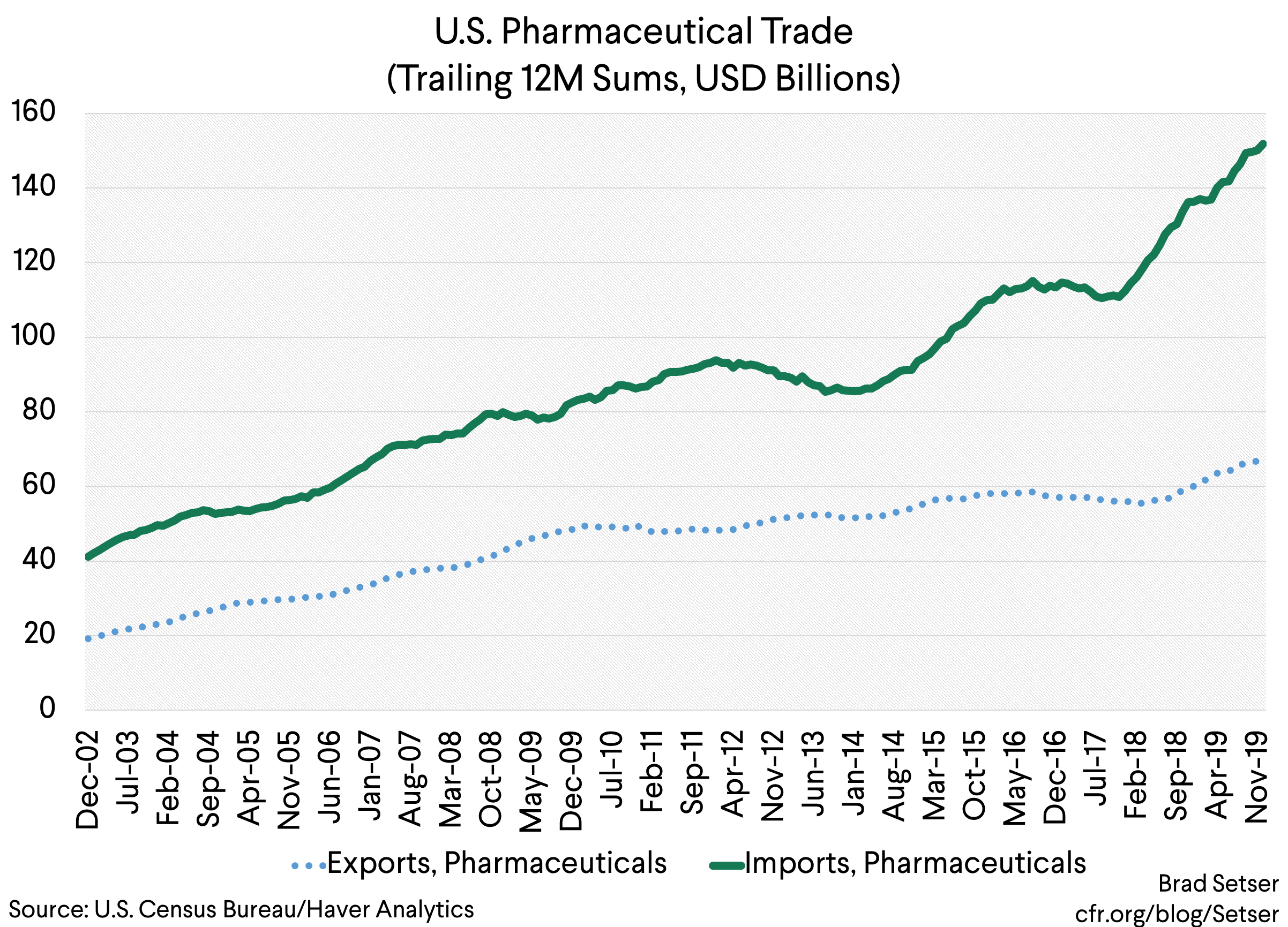

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)